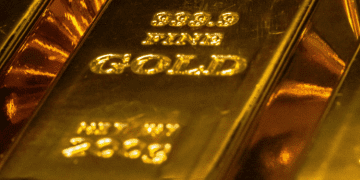

Gold Hits Fresh Record as Geopolitical Risks and Rate-Cut Expectations Fuel Momentum

Today’s markets analysis on behalf of Frank Walbaum Market Analyst at Naga

Gold surged on Monday, setting a new all-time high as geopolitical risks have intensified further, underpinning safe-haven demand. In Eastern Europe, prospects for a ceasefire appear increasingly remote despite ongoing diplomatic efforts. In the Middle East, tensions remain elevated. Meanwhile, frictions between the United States and Venezuela have escalated after US authorities pursued another sanctioned oil tanker, raising the risk of confrontation. Tensions between China and Japan also remain unresolved, adding another layer of global uncertainty.

Meanwhile, expectations of Federal Reserve rate cuts could continue to strengthen gold. Markets are now pricing in two additional cuts next year, a backdrop that continues to favour bullion. At the same time, ETF inflows have been consistent in recent weeks, while central banks continue to add gold to their reserves. Looking ahead, with year-end approaching, thinner liquidity conditions could amplify price swings. In such an environment, gold could remain particularly sensitive to geopolitical headlines and shifts in rate expectations.

Zaid Barem / ymm

ENFIELD

ENFIELD HACKNEY

HACKNEY HARINGEY

HARINGEY ISLINGTON

ISLINGTON