Today’s market analysis on behalf of Antonio Ernesto Di Giacomo – Senior Market Analyst at XS.com

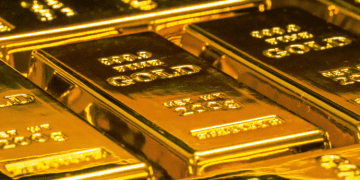

Gold reaches a new all-time high driven by dollar weakness and fed expectations

On September 13, 2024, gold reached a new all-time high of $2,582 per ounce, marking a significant milestone in financial markets. This increase in the price of the precious metal was primarily driven by the weakness of the U.S. dollar and growing expectations of an interest rate cut by the Federal Reserve (Fed). These economic factors have created a favorable environment for gold, historically performing well during financial uncertainty and monetary easing.

One of the main drivers behind gold’s rise has been the moderation of inflation in the United States. With inflation starting to show signs of slowing down, analysts have predicted that the Fed could reduce interest rates by 25 basis points. However, some more optimistic economists suggest the cut could be as much as 50 basis points. In this context, gold tends to benefit when interest rates decline, as it does not generate interest and becomes an attractive haven for investors seeking protection from market volatility and currency depreciation.

The relationship between gold and interest rates has historically been strong. When rates are high, investors tend to prefer interest-bearing assets like bonds, while when rates fall, gold becomes more attractive as a safe-haven asset. Additionally, the decline in the dollar’s value has strengthened the price of gold, as this metal is traded globally in dollars, making it cheaper for foreign investors and thus increasing demand.

Expectations of an interest rate cut have driven gold prices to historic levels and led analysts to project that the metal could continue to rise towards the end of 2024. The price is expected to reach $2,600 per ounce in the coming weeks and potentially hit $2,650 by the end of the year, depending on the course of the Fed’s monetary policy and the strength of the dollar. In the long term, some analysts do not rule out the possibility of gold reaching $3,000 per ounce, especially if global economic conditions continue to favor demand for this asset.

In conclusion, the recent rise in gold prices reflects a combination of economic factors, including the weakness of the dollar and expectations of interest rate cuts by the Fed. As monetary policies ease and demand for safe-haven assets increases, gold could continue climbing, solidifying its position as an attractive option for investors seeking protection from volatility and changes in the global economy.

Zaid Barem / YMM

ENFIELD

ENFIELD HACKNEY

HACKNEY HARINGEY

HARINGEY ISLINGTON

ISLINGTON